Table of contents

PART I: INTRODUCTION TO MANAGERIAL FINANCE

1. The Role of Managerial Finance

2. The Financial Market Environment

PART II: FINANCIAL TOOLS

3. Financial Statements and Ratio Analysis

4. Long and Short-term Financial Planning

5. Time Value of Money

PART III: VALUATION OF SECURITIES

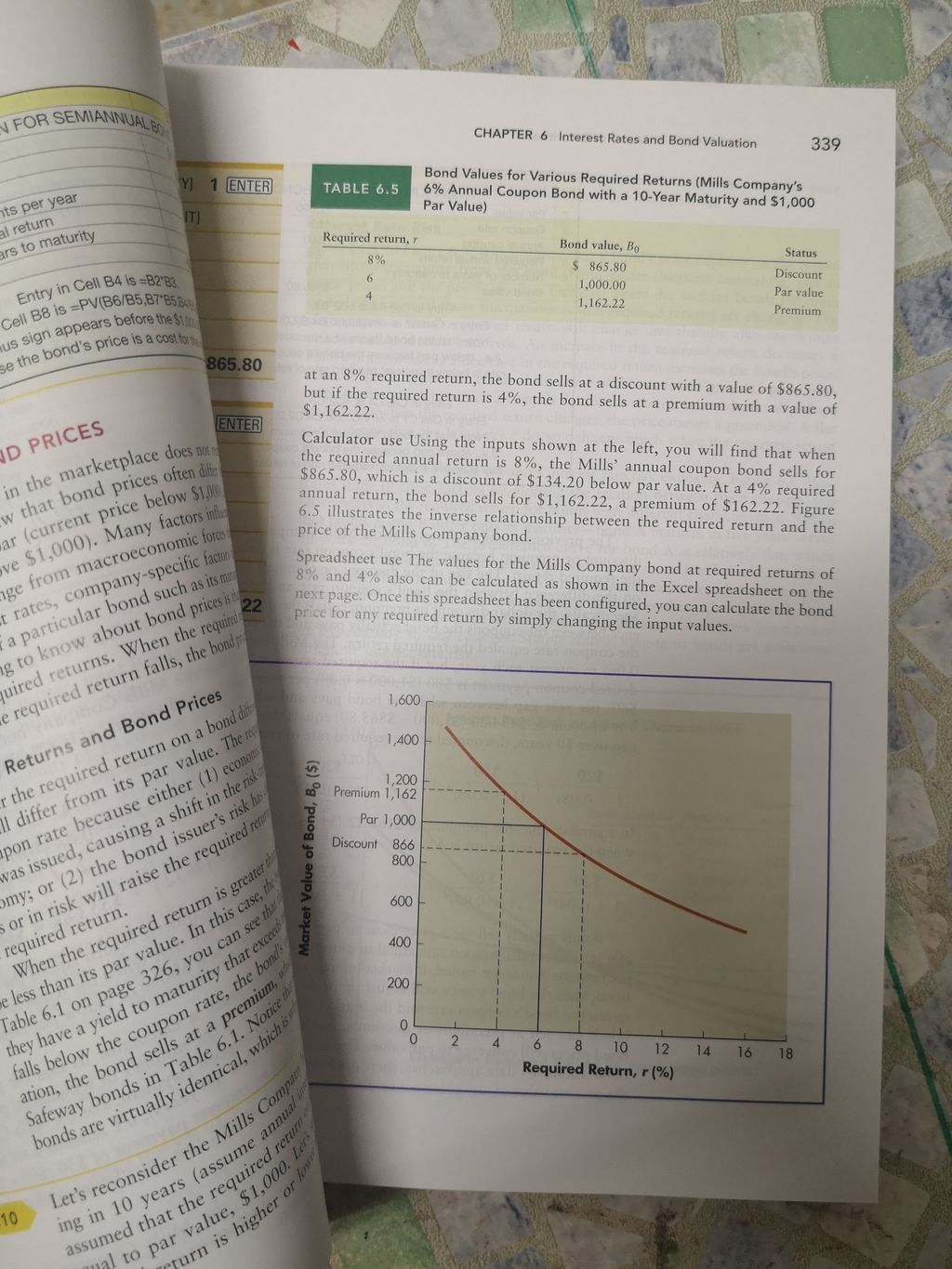

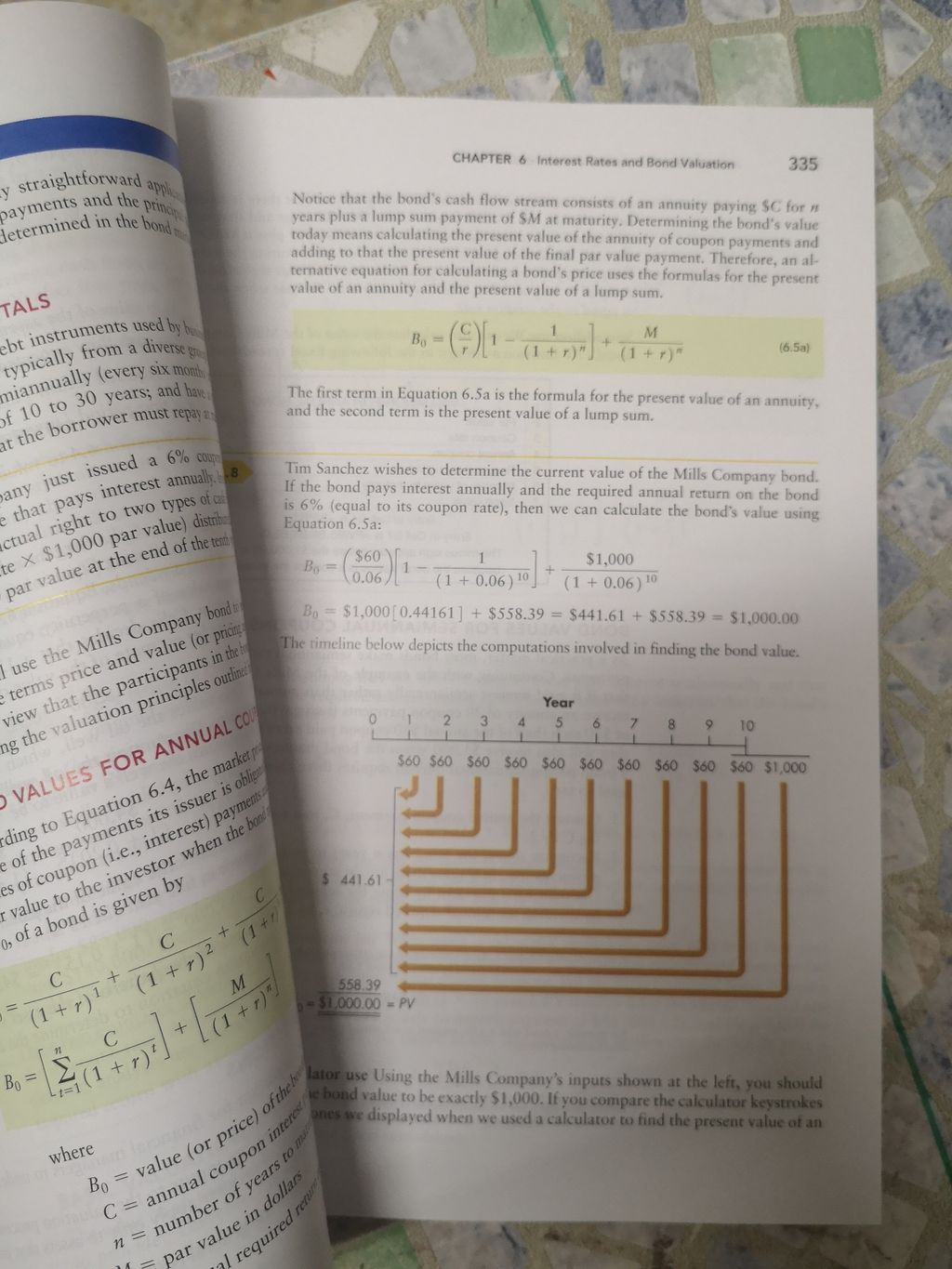

6. Interest Rates and Bond Valuation

7. Stock Valuation

PART IV: RISK AND THE REQUIRED RATE OF RETURN

8. Risk and Return

9. The Cost of Capital

PART V: LONG-TERM INVESTMENT DECISIONS

10. Capital Budgeting Techniques

11. Capital Budgeting Cash Flows

12. Risk and Refinements in Capital Budgeting

PART VI: LONG-TERM FINANCIAL DECISIONS

13. Capital Structure

14. Payout Policy

PART VII: SHORT-TERM FINANCIAL DECISIONS

15. Working Capital and Current Assets Management

16. Current Liabilities Management

PART VIII: SPECIAL TOPICS IN MANAGERIAL FINANCE

17. Hybrid and Derivative Securities

18. Mergers, LBOs, Divestitures, and Business Failure

19. International Managerial Finance

1. The Role of Managerial Finance

2. The Financial Market Environment

PART II: FINANCIAL TOOLS

3. Financial Statements and Ratio Analysis

4. Long and Short-term Financial Planning

5. Time Value of Money

PART III: VALUATION OF SECURITIES

6. Interest Rates and Bond Valuation

7. Stock Valuation

PART IV: RISK AND THE REQUIRED RATE OF RETURN

8. Risk and Return

9. The Cost of Capital

PART V: LONG-TERM INVESTMENT DECISIONS

10. Capital Budgeting Techniques

11. Capital Budgeting Cash Flows

12. Risk and Refinements in Capital Budgeting

PART VI: LONG-TERM FINANCIAL DECISIONS

13. Capital Structure

14. Payout Policy

PART VII: SHORT-TERM FINANCIAL DECISIONS

15. Working Capital and Current Assets Management

16. Current Liabilities Management

PART VIII: SPECIAL TOPICS IN MANAGERIAL FINANCE

17. Hybrid and Derivative Securities

18. Mergers, LBOs, Divestitures, and Business Failure

19. International Managerial Finance

×